Multifamily Market Cycles

Sep 26, 2025Multifamily Market Cycles: How Apartment Investors Can Profit in Every Phase

If you want to succeed in multifamily real estate investing, you need more than just enthusiasm and a hunch. The key is understanding how market cycles drive opportunities in apartment buildings — and how to adjust your strategy at each stage.

Think of market cycles as the rhythm of the multifamily industry: Expansion, Peak, Recession, and Trough. Knowing how to dance to each beat separates profitable investors from those who get stuck holding the bag.

In this guide, you’ll learn:

-

What the four multifamily market cycles are

-

How each phase impacts apartment building investments

-

Which strategies investors should use in each cycle

-

Why debt, exit strategy, and timing matter

The Four Multifamily Market Cycles

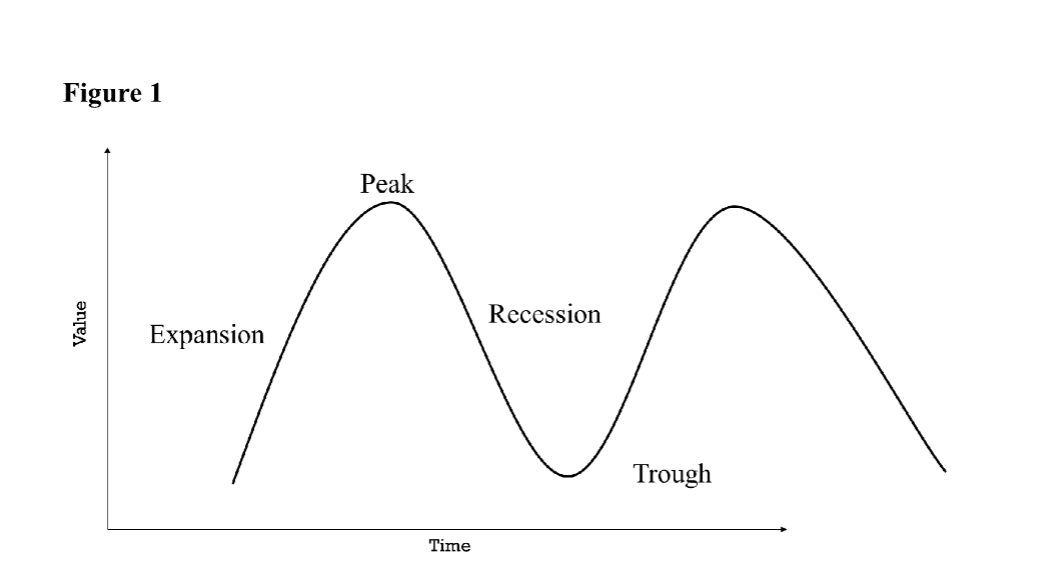

Economists and investors recognize four main phases: Expansion, Peak, Recession, and Trough. These cycles are primarily influenced by interest rates, inflation, and supply-demand dynamics.

Here’s a simple view:

1. Expansion Cycle (The Boom Phase)

The expansion phase is when the market is strong — job growth is healthy, rents are climbing, and lenders are handing out capital with favorable terms. For multifamily investors, this is often the best time to pursue value-add strategies:

-

Buying underperforming apartments

-

Renovating units to match market demand

-

Refinancing after appreciation kicks in

Smart investors move quickly here, because expansions never last forever.

2. Peak Cycle (The Market Top)

During the peak phase, prices and rents hit their highest point. Sellers ask for top dollar, cap rates compress, and lenders start tightening requirements.

This is the time for investors to:

-

Lock in long-term fixed-rate debt

-

Focus on cash flow instead of appreciation

-

Consider selling stabilized properties before the downturn

As Warren Buffett says, “Be fearful when others are greedy.” At the peak, discipline pays.

3. Recession Cycle (The Downturn)

The recession phase is when the music slows. Higher vacancies, stagnant or declining rents, and tougher lending conditions create stress.

But this is also a time of opportunity for well-prepared multifamily investors:

-

Focus on operations and efficiency (reduce expenses, improve management)

-

Avoid over-leveraging or speculative renovations

-

Target distressed sellers who must unload properties

Think of this phase as survival mode — strong operators thrive while overextended owners falter.

4. Trough Cycle (The Bottom)

The trough phase represents the market’s low point. Properties are out of favor, traditional financing is scarce, and prices stabilize at their lowest levels.

For investors with liquidity and patience, this is the best time to:

-

Acquire undervalued multifamily properties

-

Use creative financing (seller financing, master lease options, private capital)

-

Position assets for the next expansion

This is where fortunes are made — not by timing the exact bottom, but by acting while others sit on the sidelines.

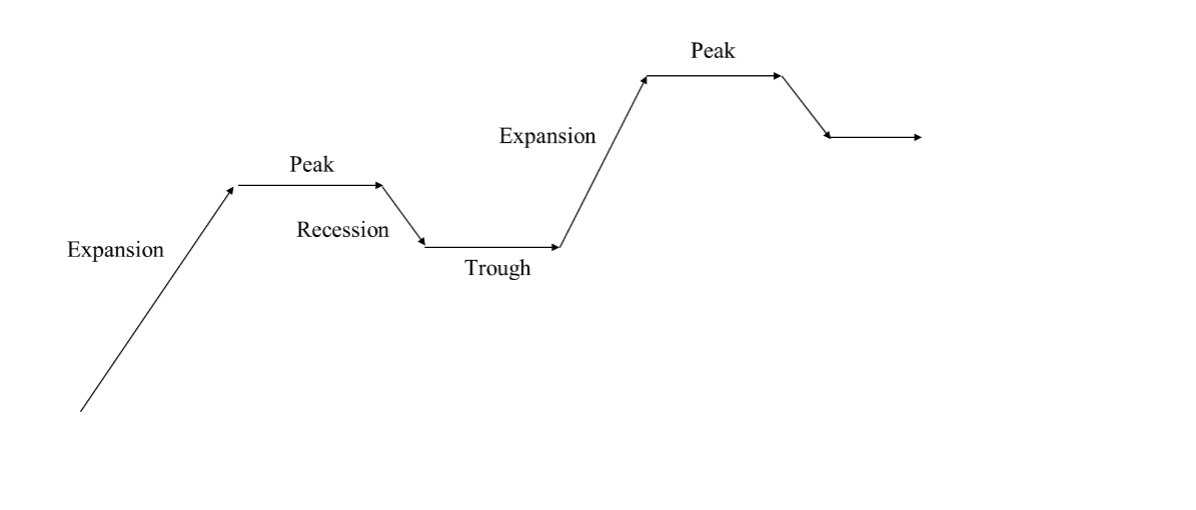

The Real Movement of Multifamily Values

While Figure 1 shows a neat curve, real estate rarely moves in perfect waves. In practice, values climb, plateau, dip, and then slowly rise again.

This explains why the myth “real estate always goes up” is misleading. Long-term, values trend upward. Short-term, market cycles cause volatility. The winners are those who adapt.

Investing Strategies Through the Cycles

Here’s how apartment investors can adjust in each phase:

-

Expansion: Pursue value-add deals, short-term renovations, and quick resales.

-

Peak: Secure long-term financing, focus on cash flow, consider partial exits.

-

Recession: Double down on management, preserve cash, buy distressed assets cautiously.

-

Trough: Acquire aggressively with creative financing, position for the rebound.

The Three Pillars of Multifamily Success

Every apartment investor must master three foundational pillars:

-

Debt – Choosing the right loan at the right cycle prevents getting caught with bad refinancing terms.

-

Exit Strategy – Always know how you’ll profit: sell, refinance, or hold long-term.

-

Market Cycles – Timing your approach with the cycle reduces risk and maximizes upside.

Together, these act like a three-legged stool. If one leg is weak, your entire investment wobbles.

Key Takeaway: Adapt or Get Burned

Multifamily real estate investing isn’t a “set it and forget it” game. It requires active strategy shifts as cycles change.

-

During expansions, growth is your friend.

-

At peaks, protect what you’ve built.

-

In recessions, survive and operate efficiently.

-

At troughs, buy boldly.

If you understand the cycles and adjust accordingly, you won’t just survive — you’ll scale a portfolio that creates lasting wealth and passive income.

Multifamily Investors!

Interested in joining a community of investors that work together to get more deals done? Or perhaps you're an experienced operator that is looking for more efficient systems or better off-market data? Book an intro call with our team so we can start to build the relationships and provide you with more information on the various ways we work with multifamily investors.